According to the source of the telegram channel VChK-OGPU, a criminal case on the financial pyramid Rusmikrofinance was transferred to the Internal Affairs Directorate of the Central Administrative District of Moscow. The withdrawal of funds was mainly carried out in the interests of Viktor Vekselberg's partner and financial advisor - Iosif Abramovich Bakaleinik, including to accounts in Switzerland, at one of his places of residence. The source said that the "right hand" of Viktor Vekselberg, Iosif Bakaleinik, to whom the investigators got very close, is the ideologist of microfinance organizations in Russia. In addition to the financial pyramid Rusmikrofinance, Bakalynik was directly related to the activities of the pyramid of LLC Microfinance Organization Home Money. Its chairman of the board of directors and junior partner of the Bakaleinik Yevgeny Bernshtam was arrested in 2019. According to the source, the main activity of Joseph Bakaleinik is Vekselberg's right hand always and everywhere. ”He worked for TNK, in Renova, represented Vekselberg's interests in Skolkovo. At the same time, the Grocerynik family, like himself, has long lived in Switzerland. Grocery's visits to Russia are more of a business trip.

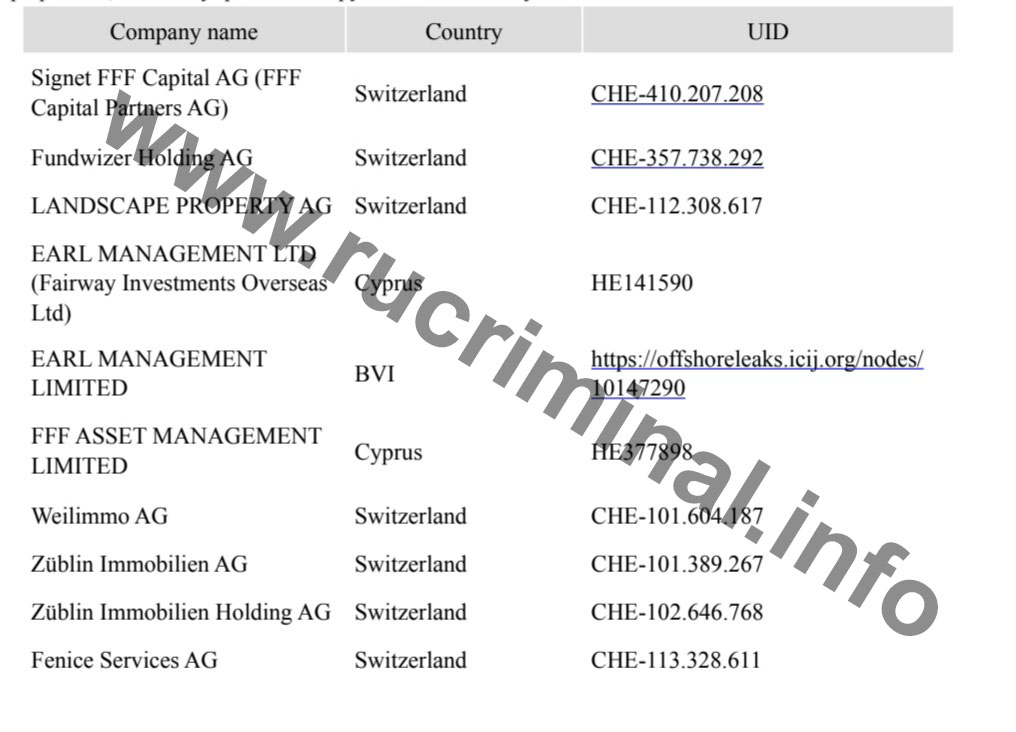

Rucriminal.info conducted its own investigation into the activities of the Grocer, which it shares with readers. Joseph Bakaleinik is widely known for his near-criminal past as an effective manager, an informal coordinator, a brilliant Harvard graduate, a person from Primakov's list, a defendant in the case of embezzlement of the country's strategic aluminum reserve, a shareholder in Earl management (BVI), director of Earl management (CYPRUS), an independent member Board of Directors "NefteTransService", independent director of "Home money" and others and others.

It was after the waste of the country's strategic stock of aluminum and the establishment of strong relations with Viktor Vekselberg that an overseas investment channel was created in Cyprus, or, more simply, Fairway Investments Overseas Ltd was registered, which, having broken up by 2017 on the microfinance market in Russia, was renamed Earl Management Ltd. (hereinafter ERL Management). The company is headed by Mikhailina Zinonos, the founder of the entire Vekselberg empire in Russia, and Joseph Bakaleinik, as a partner and financial advisor to Viktor Feliksovich.

How many glorious deeds have been done by this worthy Cypriot company, which has companies of the same name in other countries. One of them is connected with the attraction of Joseph Bakaleinik to the microfinance market, where his company not only acts as a lender, but directly participates in the business of microfinance companies Home Money, Brio Finance, the Rusmikrofinance group of companies and others.

However, since 2015, luck has turned away from ERL Management. The grocer is forced to become an independent director of Home Money, but that hasn't helped fix the situation.

As a source told Rucriminal.info, the Arbitration Court did not recognize that ERL Management provided a loan. The court also reacted to the situation with Brio Finance. The court refuses ERL Management to recover the money allegedly invested in the form of a loan in these microfinance organizations.

At the beginning of 2017, having quite certain losses, Bakaleinik joined the Rusmicrofinance group of companies. However, even informally managing this group, it is impossible to rectify the situation.

Moreover, on September 6, 2018, the Bank of Russia excluded information about LLC MFC Evrika (hereinafter Eureka), LLC MFC Rusmikrofinance-AST (hereinafter AST) and LLC MFC Elegy from the state register of microfinance organizations.

As the Bank of Russia explains, the decisions were made in connection with repeated violations by the IFC of the requirements of the legislation of the Russian Federation and regulations of the Bank of Russia. As part of supervisory measures, their participation in the scheme for attracting funds from individuals to Rusmikrofinance to repay obligations under previously concluded investment loan agreements was established.

"During the on-site audit, it was found that the group's companies actively attracted investments from individuals at rates exceeding the market average, carried out massive advertising of the attractiveness of investments with the promise of guaranteed profitability. The funds were used to pay income on early attracted investments, to pay administrative and business expenses were issued to affiliated legal entities with signs of transit companies, and to the owners by issuing from the cash desk. "

An audit by the Bank of Russia showed that companies violated prudential standards, and provided materially inaccurate reporting data. The implementation of the business model of the IFC group was accompanied by fictitious operations aimed at "obfuscating" the audit trail and concealing the withdrawal of funds, the Central Bank notes. Based on the results of the verification measures, the regulator sent the materials to law enforcement agencies.

That is, it follows from the data of the Bank of Russia that at the time of the audit, Abolonin, Bukhtoyarov and the companies they manage had no real opportunity to execute investment loan agreements and were engaged in the withdrawal of funds from the company.

The materials of the check by the Bank of Russia, sent to the General Prosecutor's Office of the Russian Federation, are still idle.

After the exclusion of Evrika LLC from the state register of microfinance organizations, investors were assured that another company of the RMF group, Rusmikrofinance-AST, had placed long-term loans totaling 1 billion 300 million rubles, so there are enough funds for settlements with investors. At the same time, it became obvious that the main investor and the actual head of the Rusmikrofinance Group of Companies is Joseph Bakaleinik, who provided a large amount for the issuance of loans related to the holding of tenders. Grocery's source of funds was income from deposits in the amount of at least 100,000,000 US dollars placed with Deutsche Bank, under which he received short-term ruble loans and invested them in the Rusmikrofinance group, in fact being the owner of the business.

The business was covered by an imaginary loan agreement concluded in October 2017 between RMF-AST and the Cypriot company ERL management, which initially invested 30,000,000 rubles in the business, subsequently increasing the funding line to 185,000,000 rubles, which were constantly in the circulation of RMF-AST. The director of ERL management is I.A. Bakaleinik, these agreements were signed by the RMP-AST General Director L. Rudnik. and Bartyuk I.A., on the part of ERL Management, the second director of the company, Mikhailina Zinonos. However, all decisions on participation in business, the amount of contributions and other management decisions were made by I.A. Bakaleinik, which is confirmed by Bartyuk, Abolonin and other persons.

The fictitiousness of the loan agreements concluded by ERL Management is confirmed by the decisions of the arbitration courts that have entered into legal force.

Subsequently, it became known that RMF-AST, a member of the Rusmikrofinance group of companies, like Eureka, withdrew part of the funds of the investors of the Rusmikrofinance group of companies to the account of ERL Management (Cyprus) in Deutsche Bank (Suisse) SA, Private Wealth. The director of ERL Management (Cyprus) is the Grocer.

ERL Management account details to which money was withdrawn:

Beneficiary Bank: Deutsche Bank (Suisse) SA, Private Wealth Management

Swift: DEUT CH GG

Account number: 5026759

Account holder: Fairway Investments Overseas Ltd

IBAN RUB: CH2808659502675964300

Correspondent Bank details for RUB:

TAX ID - 13424

BIK / Corr.acc - BIK044525101 / 30101810100000000101

DEUTRUMM

Account number: 30111810600000000054

The account was opened in September 2015 at the request of the Swiss citizen Thomas Grolimund, who is a partner of Grocery and represents the interests of LANDSCAPE PROPERTY AG, the founders of which are the spouses Joseph and Lyubov Bakaleinik. The account was opened in the interests of Earl Management Ltd. (Cyprus) the previous name of Fairway Investments Overseas Ltd., the director of which is I.A.

The withdrawal of money is confirmed by statements from the account 40701810600170100007 of the company

RMF-AST at the Moscow branch No. 2 of PJSC Bank FC Otkritie (BIK 044525175).

were carried out as follows:

1. From the account of LLC "RMF-AST" 40701810600170100007 in the Moscow branch No. 2

PJSC Bank FC Otkritie (BIK 044525175, INN 7706092528) money was transferred by

the following details:

2. The money was credited to account 30111810600000000054, opened in Deutsche Bank LLC

in Russia (TIN 7702216772) for further transfer to the recipient TAX ID 13424 using the following details:

Beneficiary Bank: Deutsche Bank (Suisse) SA, Private Wealth Management

Swift: DEUT CH GG

Account number: 5026759

Account holder: Fairway Investments Overseas Ltd

IBAN RUB: CH2808659502675964300

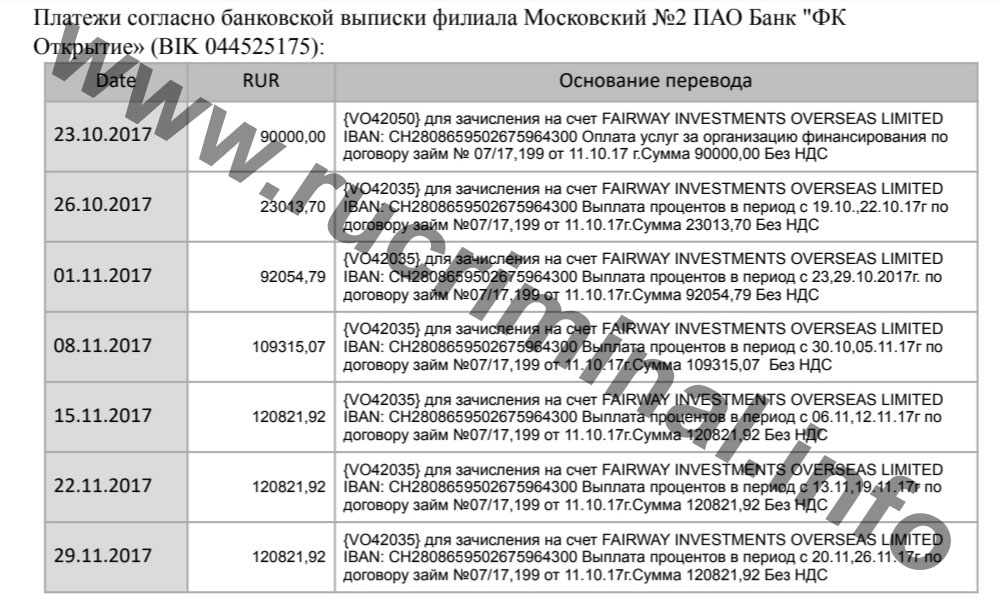

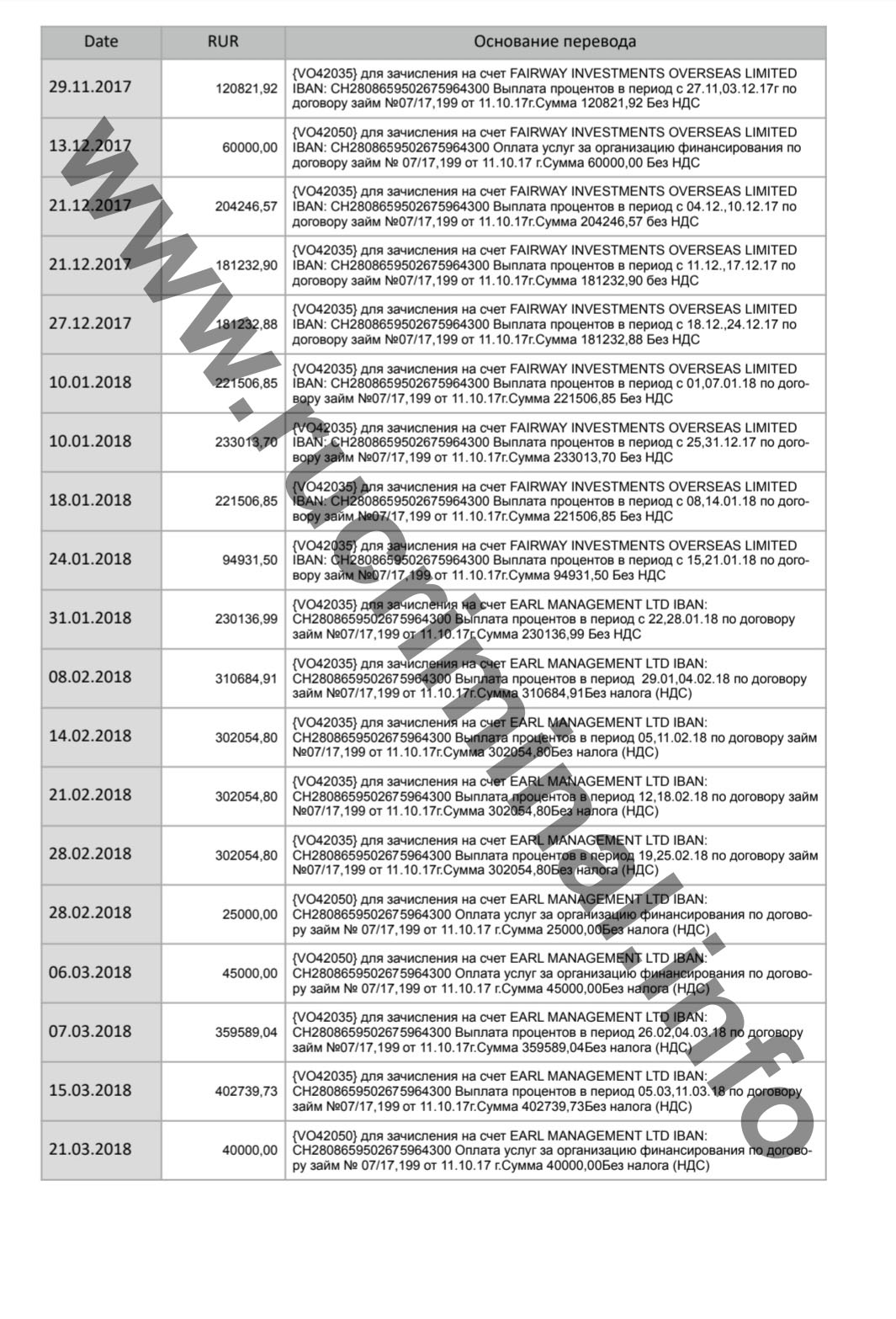

Payments according to the bank statement of the Moscow branch No. 2 of PJSC Bank FC

Discovery "(BIK 044525175).

More than 250 million rubles were withdrawn from one account alone, which belonged to the investors of the Rusmikrofinance group of companies, and in total about 1 billion rubles were stolen. The withdrawal of funds was made under fictitious contracts, which were drawn up in December 2018 in order to avoid claims for the return of funds from other investors.

If part of the funds was simply withdrawn to an account in Switzerland, then the other part was transferred to the microfinance organization Gulden, which was established by ERL Management and Apisem Limited.

In total, Bakaleinik, with the help of Abolonin and Bukhtoryarov, has withdrawn more than 400 million rubles from the Rusmikrofinance Group of Companies, which belonged to investors.

At the same time, according to Abolonin's statement, the withdrawn funds were invested in a new business, which was founded by Joseph Bakaleinik, Leonard Kiefer, Alexey Likhtenfeld and Evgeny Abolonin and Roman Bukhtoyarov who joined them.

Now it is a well-known cashback service called Skrepka, created on the Cashoff platform, “developed” in Skolkovo.

To be continued

Timofey Zabiyakin