Since July last year in the High court of London is an open trial of the infamous owner of the fishing holding “Norebo” Vitaly Orlov. Alexander Tugushev, who filed a lawsuit against Orlov, claims that he was fraudulently deprived of a 33 percent stake in the holding. While Tugushev's arguments seem to the court convincing - at least, convincing enough to for a long time to freeze assets Orlov in the amount of $350 million worldwide.

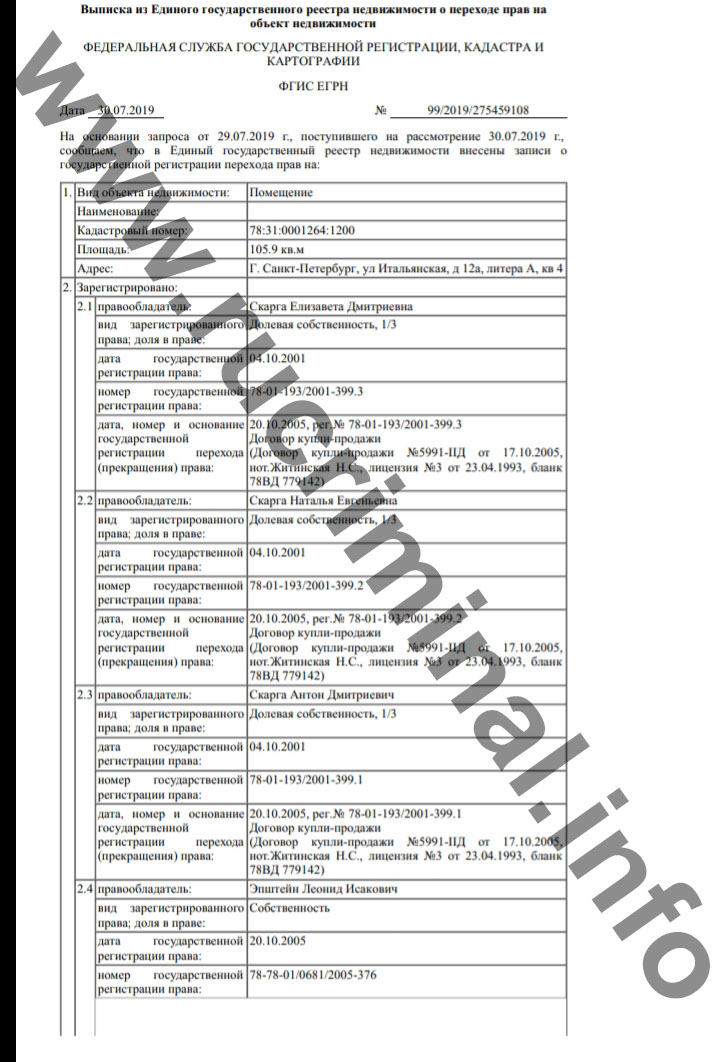

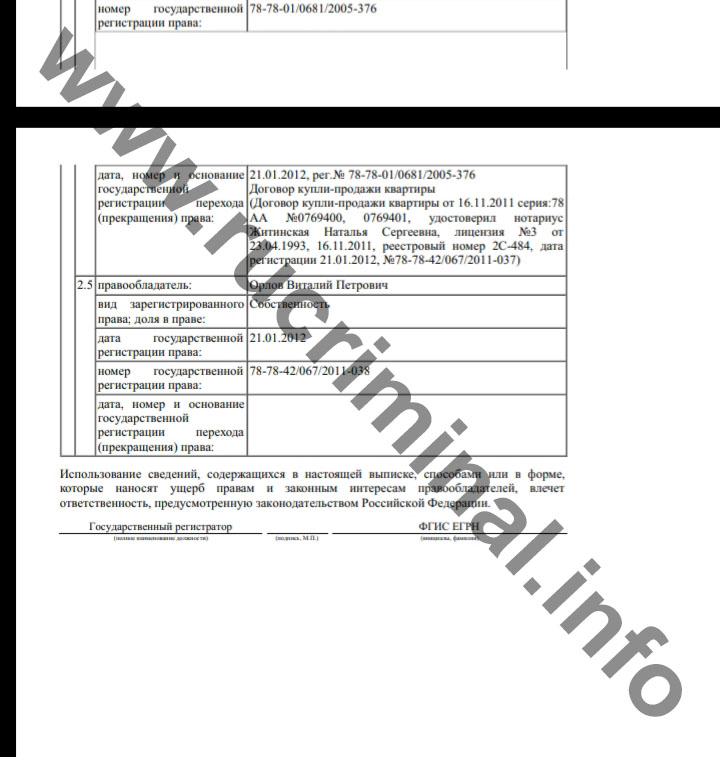

Now in the "Norebo" had an unexpected twist that explains where the money goes "Norebo" through the company in Hong Kong (this rucriminal.info tell you later). It turns out that Vitaly Orlov through his nominal in 2006 bought an apartment in St. Petersburg not from anyone, but from a convicted fraudster and sponsor of the opposition - Dmitry Skarga. Given that they are from the same business, scarga lives in London, and Orlov, as established by the High Court - a resident of the UK, it is obvious that they communicate to this day. The only problem is that Orlov calls himself a patriot, and scarga is a prominent figure of the emigrant party, regularly unfastening significant funds for the financing of the Russian opposition.

Over the past year, a lot of interesting details about the business of the holding company “Norebo” and the Orlov. For example, the public was the information that “Norebo” for many years have abused their transfer pricing and helped friendly fishing enterprises to withdraw profits from Russia through a Hong Kong company-gasket.

It also became known that Vitaly Orlov, who now denies any right of Alexander Tugushev to share in the " Norebo”, in 2015 he offered Tugushev $60 million for abandoning claims to it. Then Tugushev rejected Orlov's proposal, obviously considering the amount insufficient. It can be understood, because in 2016 another partner Orlova Magnus Roth, who also owned at that time 33% of the shares of the holding, sold him his share for almost an order of magnitude greater - $350 million.

We also learned that the position of the head of one of the largest Russian fishing holdings did not prevent Orlov from linking his future not with Russia, but with the UK. Trying to get away with it, Orlov began to deny this connection in every possible way - our Russian-Norwegian-British-Hong Kong businessman even tried to challenge the jurisdiction of the case to the High court of London, claiming that he lives and works in Murmansk, and in the UK arrives only occasionally.

However, the court of its statement didn't convince. Indeed, what kind of lack of communication can we talk about if the office of one of the main companies of the holding “Norebo” is in the UK, Orlov's children live in London, for his civilian wife Orlov made a British investor visa (in fact – a residence permit) and, finally, he has owned an apartment in London, payment for utilities for which he called “ordinary living expenses”?

After the court recognized that the claim could be considered in London, several more meetings took place. We got acquainted with all available documents, received comments of tax and financial experts and are ready to share with you new details of this dirty history.

At whose expense Orlov bought shares from his partner Magnus Roth

According to Alexander Tugushev, he was one of the founders of Norebo together with Vitaly Orlov and Norwegian Magnus Roth. Magnus Roth really previously owned 33% of the holding “Norebo”, however, as we have already mentioned, in 2016, Orlov bought the company's share for $350 million. Interestingly, it happened just at the moment when the conflict Tugusheva and Orlov began to gain momentum.

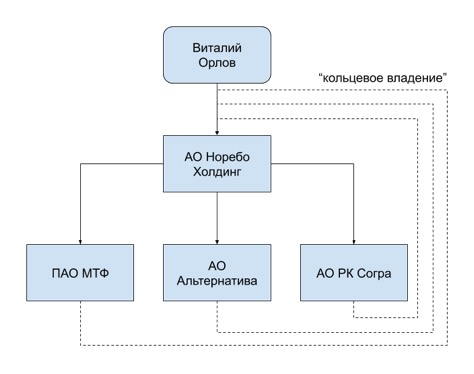

Orlov bought the shares of the Company mainly at the expense of the holding “Norebo”, which in turn borrowed funds from Sberbank. Two fairly simple schemes were used for the ransom. In the first case, “daughters” Norebo” bought from Magnus Roth shares of the parent company. This led to the so-called “ring” ownership: subsidiaries of the holding now owned shares of their own holding company. This simple scheme allowed Orlov to have full control over the company and saved him from having to pay money from his personal account.

A schematic diagram of the ring possession

In the second case, Orlov took loans from companies included in Norebo and bought shares from Roth, again using the funds of his own holding. As we see, this scheme, like previous ones, allowed the eagles to use their personal funds for the purchase of shares of the Company.

Another interesting condition in the agreement on the redemption of shares (IAS) between Orlov and Roth is the clause prohibiting Magnus Roth from helping or participating in any judicial or criminal proceedings against Vitaly Orlov on the side of Alexander Tugushev. Sounds pretty suspicious, doesn't it? Most likely, Orlov is very afraid that Magnus Roth will come and testify in the High court of London, because he will be able to say for sure whether Tugushev was an equal partner in the norebo holding.

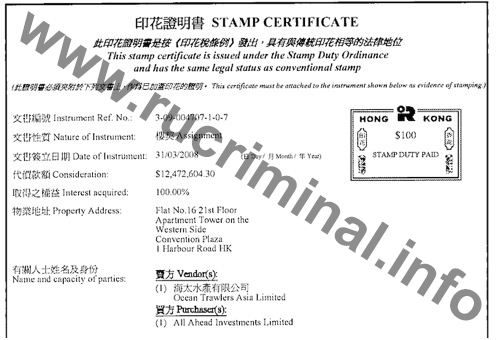

“Sale” of shares in All Ahead Investments Limited

In addition to the funds of the holding “Norebo” and their own money, Vitaly Orlov paid with Magnus Roth and shares. Roth and Orlov owned 50% of the shares of the Hong Kong company All Ahead Investments Limited. Recall that the holding “Norebo” has long settled in Hong Kong. Three Towns Capital Limited, which is an important part of the holding and which owns many foreign companies “Norebo”, is registered in Hong Kong. Through Three Towns Capital Limited and its subsidiaries, a significant portion of Norebo's products is sold and, as mentioned above, a portion of the profits made in Russia is presumably withdrawn. Norebo owned an office and apartments in Hong Kong, and Orlov even listed Hong Kong as his place of residence in Russian tax returns until 2014. In this case, the Hong Kong eagles said in court that he never lived there, only visited for work. At the court hearings in Hong Kong it was found that “Three Towns Capital Limited” did not conduct real economic activity in Hong Kong in the criteria of local tax legislation. This once again confirms that Vitaly Orlov and these companies were taxable in Russia. All these facts should arouse strong suspicions among tax authorities in Russia and Hong Kong.

The Company sold a 50% stake in All Ahead was not just handed to him. In accordance with the terms of the IAS, Orlov allowed to dilute its share to 0.02%, and then buy it for face value. At the same time, for the purposes of IAS, such a “transfer” of shares was estimated at $ 3 million. In other words, Orlov “exchanged” 50% of the shares of the Hong Kong company for the shares of the holding “Norebo”, which previously belonged to the Company. The value of the exchanged assets was determined as $ 3 million.

A closer look at the company All Ahead and its assets, we found that it recorded the Hong Kong office “Norebo” and the apartment, which and eagles, and the Mouth indicated as their place of residence until 2014.

The purchase agreement of the apartment where lived Mot and Orlov

The total value of this property is at least $ 12 million. This is four times more than the 3 million declared in the IAS. Most likely, in the IAS, the value of assets was specifically understated, in order to also understate the amount of tax that Magnus Roth had to pay from the income from the sale of shares. However, Neoplatonism Roth taxes we shall return, but first learn how avoiding taxes Orlov.

Let's start with the fact that under the law selling real estate or shares abroad, a resident of the Russian Federation is obliged to declare the income from such a sale. Orlov's income exactly received, as the apartment and office were bought in 2007-2008, and by the time of the “sale” in 2016, their price has increased significantly. The fact that the alienation of shares of All Ahead as such was not, does not matter, because the income in the form of a share of JSC " Norebo holding” Vitaly Orlov still received. According to tax specialists, structuring the transaction through the dilution of Orlov's share in All Ahead was aimed at minimizing taxation. Orlov benefited by exchanging an asset he had purchased a few years earlier for significantly less, and therefore had to pay taxes on the transaction. However, in the Declaration of Orlov for 2016 there is not the slightest trace of these revenues.

Due to the fact that the shares valued at $ 3 million (and the estimate, as we have already written, is clearly understated), were issued on Orlov personally as a physical person, this income is determined by the tax code as income from dividends, which Orlov deliberately concealed from the Russian tax. He could not be unaware of the responsibility under the criminal code for such “creativity” on the non-Declaration of income of individuals in a particularly large amount. Orlov did this deliberately and in collusion with their accomplices, speech about which goes below. Such actions have signs of fraud under article 159 of the criminal code and tax evasion under article 198 of the criminal code.

Norebo” gives loans to Orlov

Under the terms of the IAS, Orlov had to pay Magnus Roth 51 million dollars from its own funds. Of course, the Bank accounts of the person included in the Forbes list can have much larger amounts. However, as we wrote earlier, Orlov preferred to use the funds he borrowed from his own company (which took them from Sberbank), and then “repay” these loans through dividends, which Norebo paid to Orlov as a shareholder.

Here there is another problem from the field of taxes. According to established practice, if a shareholder receives a loan from its own company and does not repay it in the next year, such a loan should be considered as dividends. As we can see from Orlov's declarations, in 2016 he did not declare dividends for an amount comparable to a loan of 51 million dollars. But in 2017 and 2018 Orlov declared interest income from his own company JSC "Norebo holding". It turns out that at the same time there are debts Orlov to the company and the company's debt to him. How is that possible? It is very simple: the company declared dividends, but did not pay them, and reclassified them as a loan. Orlov also receives income in the form of interest on this loan.

Orlov for some reason did not immediately repay the loan to the company at the expense of declared dividends. Instead, he “turned” unpaid dividends into a loan and began to earn income. Moreover, in 2018, the amount of interest earned was twice as much as a year earlier. This could mean that the eagles did not do the offsetting requirements, and the amount of debt “Norebo” in front of him only increased. Such action may fall under article 198 of the RF criminal code "Evasion of the physical person from payment of taxes and (or) the physical person - the payer of insurance premiums from the payment of insurance premiums" ". The maximum penalty is three years ' imprisonment.

According to the reports of JSC "Norebo holding" for 2016-2018, it is clear that under the article “other liabilities” were reflected very significant amounts, which are most likely the company's debt to Vitaly Orlov. At the end of 2018, the balance of this debt was 65 million rubles. This may mean that Orlov has not paid off his company completely.

As a result, we see that the loans that Norebo issued to Orlov for the purchase of shares from Magnus Roth in 2016 were not repaid for at least two years. Thus, Orlov had either in the same 2016 year to reflect these loans in his Declaration as dividends, or to clarify the Declaration when he did not repay these loans in the next two years. But he did neither. Such forgetfulness is punished under the same article 198 of the criminal code.

Taxes of Magnus Roth from the sale of shares

Magnus Roth has saved $ 350 million for 33% of shares of “Norebo”. Of these, he received at least 200 million from the sale of shares in Russian companies, which could mean that he was obliged to pay 30% tax on income from this transaction. To be more precise, the amount of tax would be withheld when paying the Company for the shares themselves included in the " Norebo” companies that would act in this situation as tax agents. However, between Russia and Switzerland, whose resident is Magnus Roth, an Agreement on the avoidance of double taxation (SIDN), so Roth could theoretically pay the tax there, not here.

To pay tax in Switzerland Magnus Roth had to go to the Russian Federal tax service, to confirm there his residence in another country, to show the IAS and get a certificate that this transaction is not taxed in Russia. This had to be done, because part of the transaction was made directly between Orlov and Roth. As an individual, Orlov, in principle, can not be a tax agent (that is, to withhold tax from another person). Orlov paid the Company $ 51 million from his personal funds and allowed to blur the share in the company All Ahead, which means the company receives income from the sale of shares in kind. By law, all this simply did not leave for Magnus Roth other options, except to apply to the Russian Federal tax service. However, Roth applied the wrong procedure for declaring, so the investigating authorities can interpret these actions as follows: in the absence of a recognized tax agent, Magnus Roth was obliged to submit a Declaration to the tax authorities of the Russian Federation on the profits. However, a group of persons consisting of Orlov, Roth and lawyers representing Norebo decided not to go to the Russian Federal tax service and deliberately chose the tactic of evading the obligation to provide information on taxable income. They understood that information on such income or part of it could be qualified by the FTS as taxable in the Russian Federation.

Instead of the Declaration in FNS, eagles, and Mouth with the help of law firms HAVE asked the Finance Ministry of Russia explanations on the application of the DTT. Namely about how Magnus Roth, you should confirm your tax residency in Switzerland. The Ministry of Finance immediately replied that if a person who is not a resident of the Russian Federation, will provide a certificate of his foreign tax residence, it will be enough that the tax agent could not withhold 30% of the payment for transfer to the budget of Russia. The very fact of prompt receipt of such a letter from the Ministry of Finance is alarming. It turns out that the Ministry of Finance without further hesitation took responsibility for the failure of the Russian budget about $ 100 million (about 6 billion rubles), which is extremely unusual for Russian officials. However, most likely, everything happened just the same quite typical way. With the Ministry of Finance of such a letter agreed lawyers from the firm EPAM, in which one of the partners is a former classmate of Vladimir Putin, Nikolai Egorov. This company is famous for its ability to “resolve issues” with government agencies and corporations for a certain percentage of the transaction amount.

As previously published, the EPAM has already offered Orlov to solve the problem with Tugushev in exchange for 10% of the holding's shares. About Egorov himself, it constantly turns out that he owns a small share in some next profitable enterprise, for example, in Antipinsky oil refinery or Zagorsk Pipe Plant.

Of course, Magnus Roth provided a certificate of tax residence of Switzerland from the Canton of Ticino. It should be noted that the tax on such income in this Canton — 41%, which is much higher than the Russian 30%. From this it can be assumed that Roth hardly actually paid the tax there. This certificate was used as a cover for two purposes. First, the company “Norebo”, controlled by Orlov, did not withhold tax from the Company. Secondly, the compliance Department of Sberbank, through which these huge payments were made, did not ask unnecessary questions about the tax consequences of such a transaction. Moreover, the certificate relating exclusively to the part of the transaction between Roth and Norebo companies was illegally applied for the transaction between Roth and Orlov. And Sberbank, in which Orlov opened an account, it is also “missed”.

Responsibility for the improper performance of the tax control function rests with the taxpayer. If the wrong form of Declaration was chosen intentionally, as in this case, and among the payers there is a company headed by Orlov through the management company, the criminal and administrative responsibility for the tax crime in the form of imposing fines and other types of liability under the civil code and the criminal code is imposed on both the companies themselves and Orlov as their Director.

Moreover, if we take into account the law enforcement practice under article 159 of the criminal code, the accomplices of these tax crimes Orlov are officials of the Ministry of Finance, who, having entered into a criminal conspiracy with an organized group of persons, including employees of Sberbank, their deliberate acts and using their official position caused damage to the state in a particularly large amount of up to 6 billion rubles. The stage of recognition of a state as a victim usually does not take much time for the investigating authorities.

“Cooperation” Sberbank and “Norebo” are not limited to, questionable payments and lending of money under the transaction, causing especially large damage to the state. According to media reports, senior Vice President and former Board member of Sberbank Alexander Bazarov is the godfather of one of the children Vitaly Orlov. Perhaps that is why the compliance of Sberbank so easily misses any payments “Norebo” and personally Orlov and closes his eyes to the purchase of " Norebo” new ships at inflated prices. According to our information, in 2018, the Norebo holding acquired two vessels, called Brimnes and Ilivileq, for 28 and 36 million dollars, respectively. When compared with the prices of similar vessels, it turns out that Norebo overpaid at least 40%. And here the savings Bank? Despite the fact that these vessels purchased with borrowed funds and are mortgaged to it. Since the prices are too high, Sberbank risks to remain in a strong loss if the court will have to sell to repay the loan. In this episode, the accomplices of the crime are both employees of Sberbank, who coordinated loans and payments for these transactions, and, apparently, the financial organization itself.

Finally, for the implementation of this scheme for the redemption of shares may be criminal liability (article 193 of the criminal code). ("Evasion of duties on repatriation of money in foreign currency or currency of the Russian Federation"). For evasion of repatriation of foreign currency earnings made in especially large size by the organized group of persons with use of obviously false document and with use of the legal entity created for Commission of the crimes connected with carrying out financial transactions and other transactions with money and property, is punished by the penalty and imprisonment for a period of up to 5 years.

The agreement on the purchase of shares as evidence

The steps above were the subject of the Agreement to purchase shares entered into by and between Orlov, Roth and companies of the holding “Norebo”. The agreement covered a wide range of transactions regulated by different types of tax reporting in Russian tax and criminal law. As we can see, these transactions were made in violation of the law, so the presence of such an agreement in the terms of claims by Alexander Tugushev indicates banal fraud (Art. 159 of the criminal code).

PS: Personal company for personal purposes

As we have already told above, Vitaly Orlov used Norebo funds to become the owner of 100% of the holding's shares. However, this is not the only example of the use of Orlov company funds for personal purposes. It turned out that JSC "Norebo holding" pays civil wife Orlova 500 thousand rubles a month for some services under the contract. Of course, a company that belongs to the eagles and is controlled by him, may by his order to transfer funds to anyone. However, the transfer of funds under a fictitious contract is illegal, even if they are transferred to a civilian wife.

Thomas Gordon