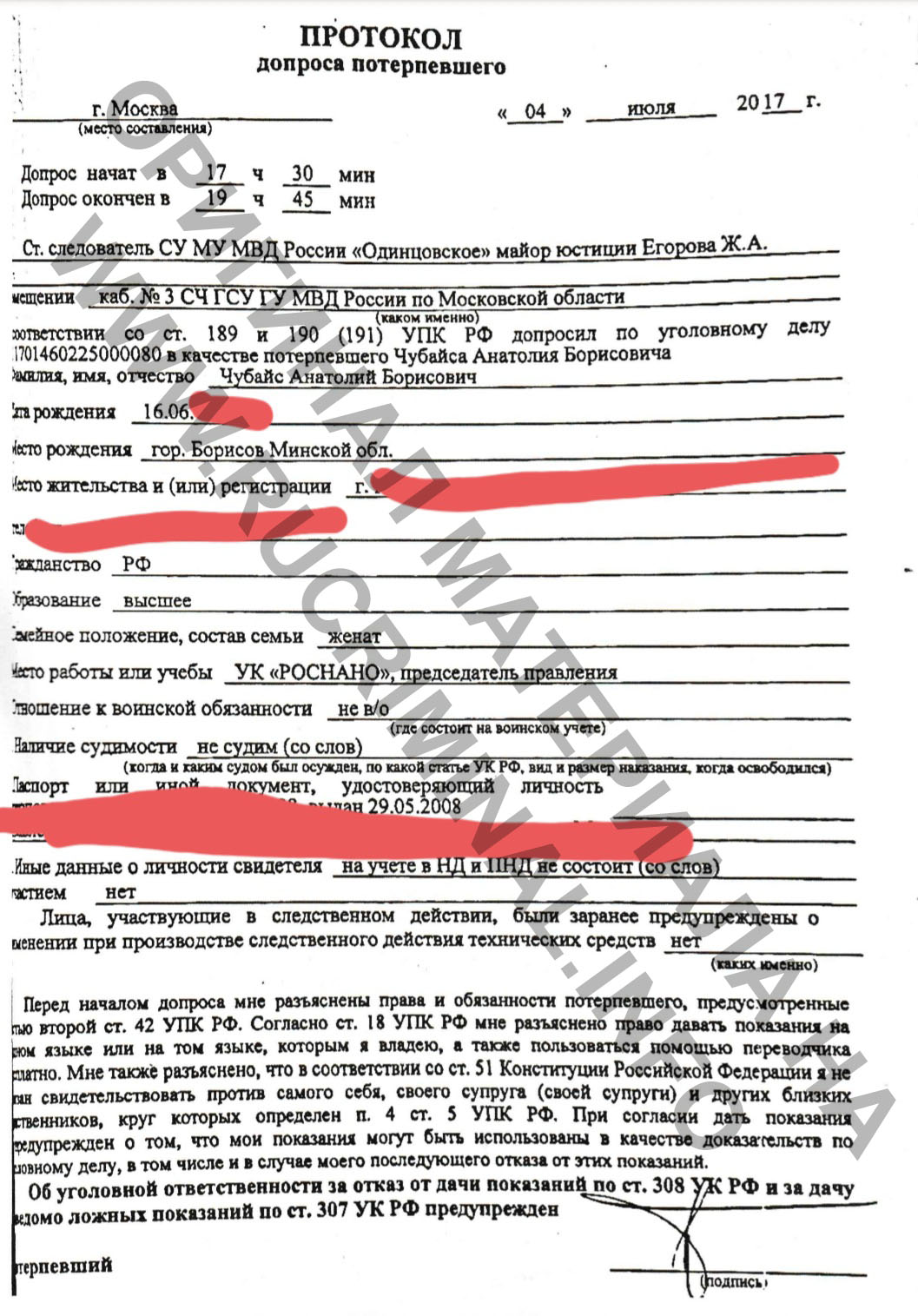

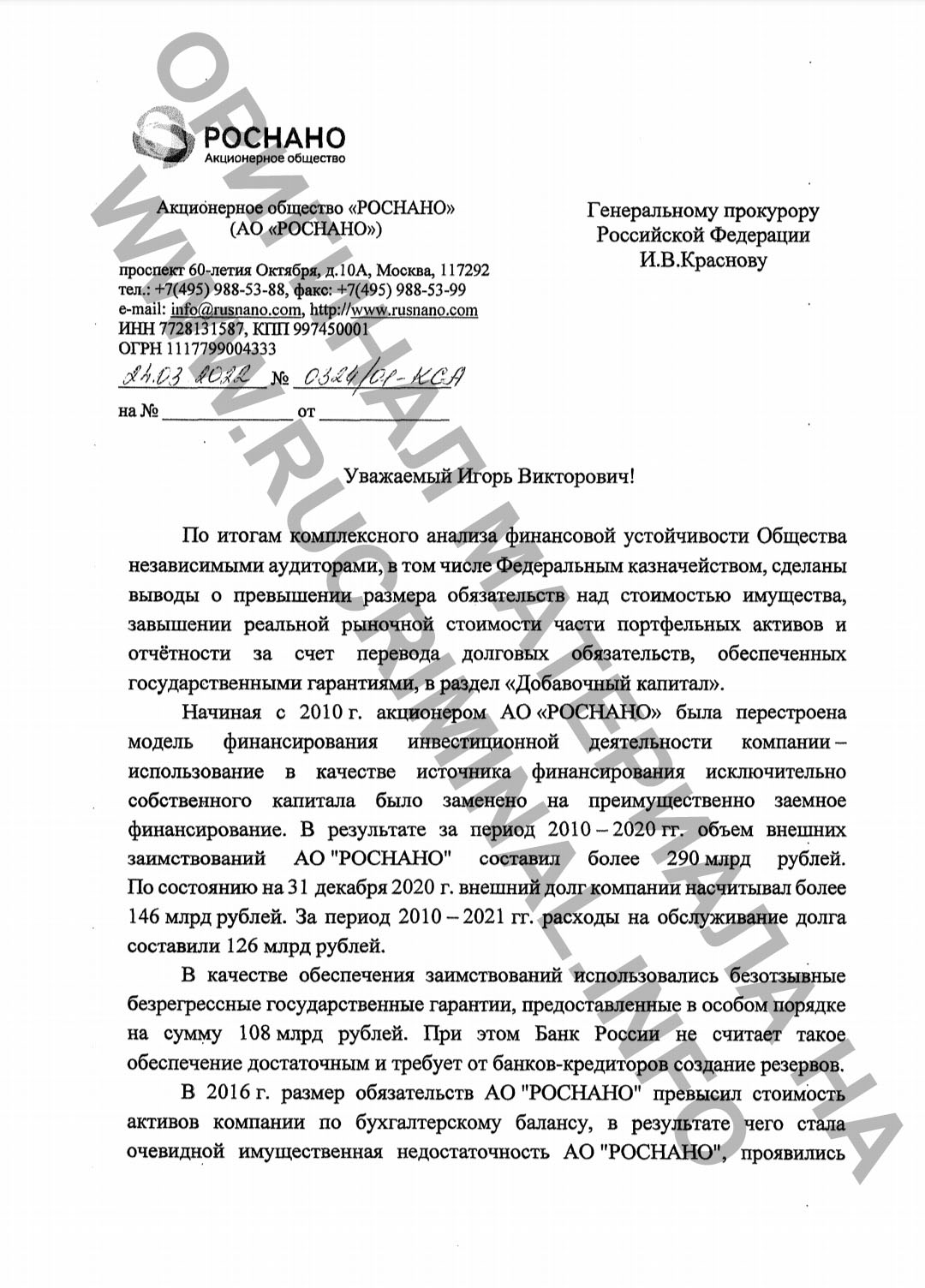

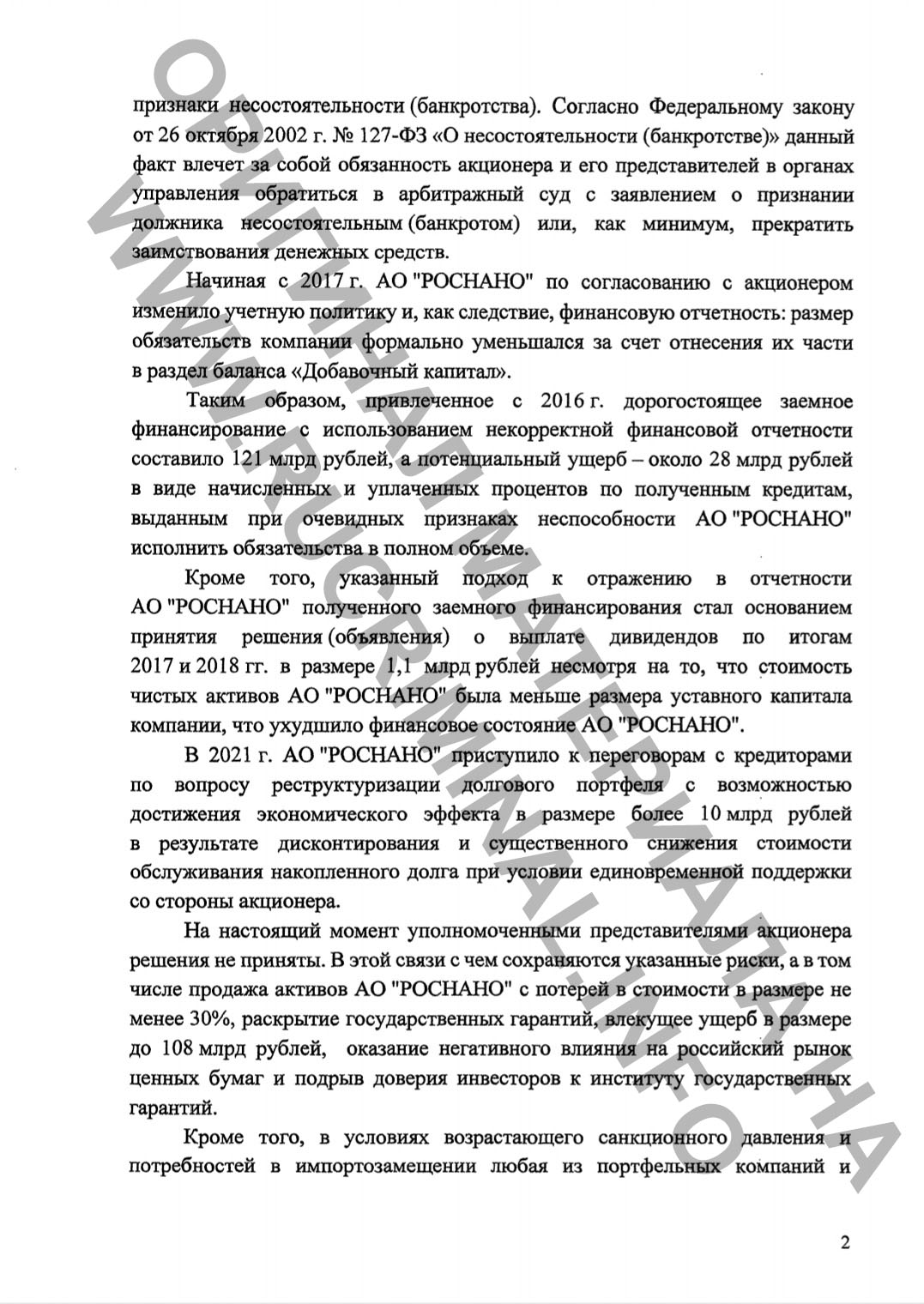

On March 24, 2022, the new head of RUSNANO S. Kulikov informed the Prosecutor General of the Russian Federation I.V. Krasnov about the results of a comprehensive analysis of the company's financial stability and asked to conduct an audit based on the circumstances set out in the letter.

The problems suddenly raised by S. Kulikov were described in detail in previous publications by the telegram channel of the VChK OGPU and Rucriminal.info. Huge debt load, poor quality of projects, losses are a direct consequence of the financial policy pursued by A.B. Chubais.

So, how did the financial policy of RUSNANO and its executors change?

A.B. Chubais became the second (in a row) head of the company. The first head of Melamed Leonid Borisovich worked as the General Director of the State Corporation "Rosnanotech" for a fairly short period of time - from 2007 to 2008. His tasks were to launch a new project with new people and leave the post after Chubais finished reforming the Russian power industry. It should be noted that Melamed coped with the tasks set: the State Corporation "Rosnanotech" was established, 130 billion rubles of property contribution were received from the state, the company's investment policy was outlined, an investment team of 7 managing directors was formed (people for Melamed are new, absolutely not connected with energy) , employees of supporting departments, including lawyers, financiers, economists, personnel officers, etc., were hired. Melamed invites Svyatoslav Ponurov from the Alemar Bank controlled by him (a professional person, but very gentle, careful and conflict-free).

In July 2008, the reorganization of RAO UES is completed and Anatoly Chubais becomes the General Director of the State Corporation Rosnanotech.

At the end of 2008, Yakov Urinson, former Chubais's deputy for RAO UES, came to the company as deputy general director. Yakov Moiseevich - former Deputy Prime Minister and Minister of Economy of Russia, can and knows how to organize work. Very soon, a whole team of former employees of RAO UES will be formed in RAO UES, who first strengthen and then head the financial, economic, corporate, legal, personnel departments, as well as office work.

It should be noted that at that moment there were 130 billion rubles on the company's account - a huge amount of money! This money "burns hands" and causes an irresistible desire to spend it. That is why the financial policy of A. Chubais assumed an unconditional priority for investment activity. In return, the managing directors were required to carry out projects at any cost. The company sets targets for the development of money - the so-called "shaft plan" and "guillotine", which involves the dismissal of the managing director who has mastered the least amount of money. Any requests from the investment block, from project financing to economic support of activities, had to be satisfied by all divisions of the company in full and as soon as possible. Financial planning and responsibility for results, reporting and control were proclaimed manifestations of bureaucracy that hindered the investment process. The absence of any restrictions and the unconditional support of the first person played a cruel joke on the company: young romantics, who have received unlimited finances and trust, quickly get into the habit and mass development of money begins in all areas: projects (the more the better), expertise, forums, personal business class cars, salaries and business trips - very soon management costs reached 6 billion rubles a year!

Such anarchy horrifies Jacob Urinson. Attempts to somehow regulate financial activities give rise to a tough confrontation within the company: on the one hand, the investment block with Chubais, on the other hand, Urinson and his team, immigrants from RAO UES.

Very soon, S. Ponurov leaves, who was not ready for a tough confrontation, and Andrey Gorkov, the former general director of the Stavropol State District Power Plant, comes in his place - a tough, systematic, hard-working person with a good production background. Systematic work begins on the introduction of a system of planning and budgeting, financial control, and cost reduction in the company.

However, the tough clinch of the financial and investment blocks ends with the personal defeat of Yakov Urinson - the financial block is no longer subordinate to him and Oleg Kiselev, who was previously responsible for the company's business strategy and has fantastic diplomatic skills, becomes the new curator of Rosnano's financial activities.

Rucriminal.info wrote a lot about Oleg Kiselev: student, researcher at MISiS, deputy director of the Institute of Chemical Physics of the USSR Academy of Sciences, founder of the Alfa-Photo cooperative, on the basis of which Alfa-Bank was later born, founder of IMPEXBANK, chairman of the board of directors CJSC "Sixth Channel" (TVS), etc. In 2004, the interests of O.V. Kiselev intersected with the interests of A. Usmanov, which resulted in a criminal case of fraud and Kiselev's departure to London. The case ended happily for Kiselyov, but his two accomplices received suspended sentences, and three more received a colony-settlement. Life itself taught O. Kiselyov based diplomacy and the ability to solve problems avoiding direct conflicts.

Oleg Kiselev very quickly plunges into the problems of financial and economic activity and .... continues the work begun by Urinson. Even A. Gorkov, despite the ultimatums of managing directors to Chubais, remains in his position. Of course, the confrontation in the company became less severe: Kiselev, on the one hand, agreed with the financial policy imposed by Chubais, fixing the priorities of investment activities, but, on the other hand, continued to formalize and regulate project activities, introduced mechanisms for an objective assessment of the effectiveness of projects.

By 2011, a system for modeling investment activity had been formed in Rosnano, now the promises of investment managing directors were digitized and turned into concrete plans. And then it turned out that all the early promises made by the investment block began to melt away sharply: to be greatly reduced in size, or to be postponed to a later period. In the 2012 report, there are objective assessments of the company's investment activities, managing directors responsible for projects, and the conclusion that the company, starting in 2014, will not be able to afford to borrow new funds without a fundamental restructuring of the company's investment activities.

The most important conclusion! Once again: Starting in 2014, Rusnano will not be able to afford to borrow new funds without a fundamental overhaul of the company's investment activities.

As a source told Rucriminal.info, the era of romanticism finally ends in May 2013 after the release of the audit report of the Accounts Chamber of the Russian Federation. The act was devastating, especially in terms of evaluating the company's project activities. The conclusions of the work of the Accounts Chamber of the Russian Federation were sent to all law enforcement agencies, including the Prosecutor’s Office, the Federal Security Service of the Russian Federation, the Investigative Committee, the Ministry of Internal Affairs, etc. The audit of the Accounts Chamber radically changes the company: the bureaucracy, which they fought so hard for all previous years, is flourishing: "the more paper, the cleaner w ... but" - the most popular saying in Rosnano at this time. The board is literally running from any responsibility and employees are sensitive to the mood in the company.

At the same time, the political situation in the country is changing, Chubais's administrative weight is falling, and his ability to attract budget funds to the company is declining. As a result, the amount of funds in the company's accounts and the ability to finance new projects are drastically reduced. Other development institutions are actively developing, such as RDIF, Skolkovo, and new mechanisms to support innovation are being launched.

Chubais and Rosnano are becoming less and less interesting both for the state and for the business elite.

According to the new strategy developed by Bain & Company, since 2014 Rusnano has stopped investing in production projects directly, giving priority to funding funds, old projects (they will now be called the Legacy portfolio) are subject to gradual write-off. The corporate management structure of the company is changing: OOO Management Company Rosnano is being established, which is transferred to the functions of the General Director of JSC RUSNANO.

None of the goals declared by the new strategy will be achieved: the funds created in the period from 2014 to 2019 at the expense of Rosnano will not receive investments from large private investors and will not launch a single more or less significant project. At the same time, the transparency of spending the state-owned company's funds will significantly decrease, as well as the responsibility of the members of the board of Rusnano for the investment decisions made.

The financial model of the corporation assumed three sources of financing for the corporation's activities: property contributions (the same 130 billion rubles); borrowed funds attracted under state guarantees of the state (credits and bonds); income from projects (the so-called Legacy portfolio). Moreover, the volume of income from projects since 2013 should have provided servicing of loans and borrowings.

In the absence of income from project activities and new injections from the state, A. Chubais formulates a new, “ambitious” task for the financial block to replace the failures in project revenues by attracting new borrowed funds. Solving problems that violate financial and economic laws was not part of the plans of Oleg Kiselev and Andrey Gorkov. In 2013, Oleg Kiselev will move to the position of head of the investment division, and Gorkov will leave with him.

Responsible for finances in the company from now on will be already familiar from previous publications of the Cheka OGPU Member of the Board Boris Podolsky and CFO Oleg Evseenkov.

Boris Podolsky will come to the company from his position General Director of CTC Media, his work experience includes work in the audit company Ernst & Young and OJSC MTS. Oleg Evseenkov also has extensive experience, including in the economic department of RAO UES of Russia, in the positions of Deputy General Director for Economics and Finance of OAO RAO Energy Systems of the East, Minister of Industry, Innovation and Information Technologies of the Ryazan Region. In less than a year, Evseenkov will honestly assess personal risks and leave the company. Artur Galstyan, former financial director of the MENATEP-IMPEX concern, the MDM group and the EuroChem concern, the investment company A1 (Alfa Group) will become the new financial director.

From this moment, the financial direction in the company becomes the key one, all members of the board and all deputies of the chairman of the board of Rusnano will be included in the issues of raising funds. Through the efforts of Anatoly Chubais, Boris Podolsky, Artur Galstyan and Andrey Trapeznikov, a beautiful picture of the most innovative company in Russia will be painted, the rules for providing state guarantees and accounting policies will change. The goal is to raise as much money as possible.

At the same time, the privatization of OOO UK Rosnano is being prepared, which, according to Chubais, should be bought out by members of the board.

Members of the board consider the issue of privatization of the management company already resolved. In 2015, the issues of managing a private management company are fixed by the Partnership Agreement, after which the members of the board begin to call themselves Partners, and the board of Rosnano turns from a working body into an elite club. Elitism cost huge money, which was spent on offices, vehicles, salaries and bonuses, the maintenance of personal lawyers, etc.

About all this, as well as about how the President of Russia stopped the privatization of the management company, the Cheka of the OGPU wrote in detail in his early publications.

Chubais left (or rather ran away), and behind the beautiful facade there was nothing but gigantic debts, for which the state and gullible bondholders will pay.

To be continued

Denis Zhirnov

Source: www.rucriminal.info